It’s a Great Time To Buy a Home!

When choosing a buyer’s agent, it is important that you have every confidence in the agent’s ability to represent your best interests. When purchasing a property in today’s market, it is not unusual to find more than one buyer trying to secure the same property.

Because of the competitive real estate market, your agent must be educated, aggressive, know current values, and also be respected by his/her peers. A reputation for high ethical standards and attention to detail is a must when negotiating for that desirable property.

A smart listing agent will not advise a seller to consider price only – there are many additional factors that an agent should keep in mind. One of these is the agent representing the buyer and his/her ability to achieve a successful closing.

Before you get started, do some homework.

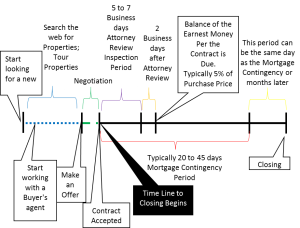

Below is a time line of the buying process.

Click on the image below to see a full page view of the buyer’s timeline.

This handy Buyers Guide will show you some things to keep in mind as you are hunting for that home of your dreams.

Starting

Finding the Right House

How much house you can afford is largely dependent on how large a mortgage (basically, a home loan) you can handle.

Start your research by using our simple mortgage calculators in the buyers tab above to see whether you can afford to pay the monthly mortgage on the type of homes you have in mind.

We also encourage you to make application with a lender before you start looking for a home. This is called getting pre-approved for a loan; it will tell you exactly how much you can afford and may make the closing process go faster.

Remember searching for a home involves more than just a monthly mortgage. You’ll also have to consider monthly payments for taxes, insurance, and potentially monthly assessments. When making an offer you’ll need to have money on hand for earnest money. After closing on a home all home improvements will be on your dime.

Payments you may have to make when you submit an offer and at closing include:

- Earnest money, usually 1% to 5% of the cost of the house, which you pay as a deposit on the house when you submit your offer. It is your proof that you are a serious buyer

- Down payment, usually 10% to 20% of the cost of the house, which you must pay at closing

- Mortgage insurance, paid by borrowers making a down payment of less than 20%

- Closing costs, usually 3% to 4% of the cost of the house, to pay for processing all the paperwork

Don’t forget the day-to-day expenses you may incur once you own that home.

This includes:

- Utilities

- Homeowner or condo association dues

- Property taxes

- City and/or County taxes

Apply to the old rule – You don’t want to be house rich but pocket poor!

Start Searching

Kicking the Tires

House hunting can be both exciting and frustrating. Most home buyers see roughly 15 houses before buying one. To make the search easier and faster, nearly half of all house hunters today begin by browsing for properties on the Internet, using web sites like this one.

The internet is a quick way to see whether the houses that are currently available meet the following critical criteria: in the right location, with the right features and at the right price. If you find after your internet search that few properties meet with your expectations, you may want to readjust your criteria change the location, features, price to increase your chances of finding a house that works for you. If you have any difficulties in this initial search, feel free to contact me for assistance. Homes can become available instantly and your agent is always the most current resource for literally up to the minute new home listing information.

Once you know what you want, where you want it and what you can afford, its time to see the houses for yourself. To help stay focused, bring with you a checklist of things that you’ve decided ahead of time are important qualities of your future home.

This might include:

- Is there enough room for you to grow in?

- Is the house structurally sound?

- Is the house in move-in condition or will it need work?

- Is it close enough to everyday needs, such as grocery stores, schools, work?

- Will you feel safe here?

- Do the appliances that are part of the sale work?

- Is the yard right for your needs?

- Do you like the floor plan?

- Is there enough storage?

- Will you be happy in this house in winter, summer, spring, fall?

- You may also want to take some exterior and interior photos of each house you visit so that you can keep track of its pros and cons.

You certainly want to be happy with your new home but try not to get paralysis through analysis…

Start Searching

Hire a Pro

While you’re not required to use a real estate professional, it is a good idea.

A professional has access to a network of contacts and can draw from extensive market knowledge to help pinpoint the right house for you quickly.

A professional also can help you structure your deal to save money, explain the advantages and disadvantages of different types of mortgages and guide you through the paperwork.

And best of all, our professional services are at no cost to you!

Loan

Get a Loan

There are a variety of mortgage types available today, each with advantages and disadvantages depending on how long you plan to live in the home, the financial marketplace and your income potential, among other things.

A fixed-rate mortgage is the most common. In a fixed-rate mortgage, your interest rate and payment stay the same for the life of the loan. An adjustable-rate mortgage usually starts out at lower interest rates and lower monthly payments than fixed-rate mortgages, but your rate and monthly payments may rise and fall based on a financial index.

There are also several government mortgage programs available, including FHA mortgages, which are designed to help people who might not otherwise qualify for a loan.

You may also have a choice in loan terms. There are 30-year loans and 15-year loans.

Offer

Making an Offer

When you’ve found a house you really want, its time to make the offer. How much you offer may depend on a number of factors:

- Is the asking price fair? Here’s where the legwork you put in while shopping for a home pays off. Decide whether this house is priced right or out of line in the current marketplace.

- Is the house in good condition? Is this house in move-in condition or will it need a lot of work? Take any costs of improvement into consideration when deciding your offer price.

- Has it been on the market long? Usually the longer a house has been on the market, the more likely it is the owner would accept a lower offer. Or maybe its just overpriced for the market.

- Is it a sellers’ or buyers’ market? If the houses you’re interested in are being bought as soon as they’re listed, that means you’ve got a lot of competition from other buyers; offer accordingly. If houses aren’t selling fast, you may have more leverage in negotiating a lower price.

Once you’ve determined how much you’d like to offer, work with your real estate professional to submit the proper information. This includes:

- A complete, legal description of the house

- The amount of earnest money you’re paying

- The down payment and financing details A proposed move-in date

- The price you’re offering

- A proposed closing date

- The length of time your offer is valid

- Details of the deal

This can be just the beginning of the negotiation process. The seller has three options: accept your offer, counter your offer or reject your offer. Let your real estate professional advise you on the best way to present your offer for a good outcome.

Process

Offer Process

When your offer has been accepted, the contingency period begins. This is time that allows you to obtain financing, perform inspections and satisfy any other contingencies of your purchase agreement.

Obtaining financing might include loan approval, which will include an appraisal of the property. Also be prepared to make your down payment, which is usually due several days before the close of escrow.

Now is the time to schedule a professional inspection of the property; it is one of the best safeguards you can take before buying. A home inspector should check the electrical system, plumbing and waste disposal, the water heater, insulation and ventilation, water source and quality, pests, foundation, doors, windows, ceilings, walls, floors and roof.

Keep in mind that the inspector isn’t there to tell you whether you’re getting a good deal. He or she is there to give you an educated and professional opinion on whether the house is structurally and mechanically sound and fill you in on any repairs that are needed.

Insurance

Homeowners Insurance

A paid homeowners insurance policy is required at closing.

Often a real estate professional will help make sure your insurance company and your title officer are working together to put your policy in effect by the close of escrow.

If you get your insurance agent involved early in your home-buying process, he or she may also help point out ways to help keep your insurance premiums lower.

Closing

Closing your Sale

When the property you’re buying has been inspected and you’ve had your final walk-through of the property to see that all contingency conditions, such as agreed upon final repairs, have been met by the seller, it’s time to face the final paperwork.

You will be signing loan documents and closing papers as well as paying the balance of your down payment and closing costs.

This is the day you get the keys to your new home. Congratulations!

Start Searching